- HOME

- >

- Accounting

- >

- Distributed Ledger Technology Drives ROI

ARTICLE

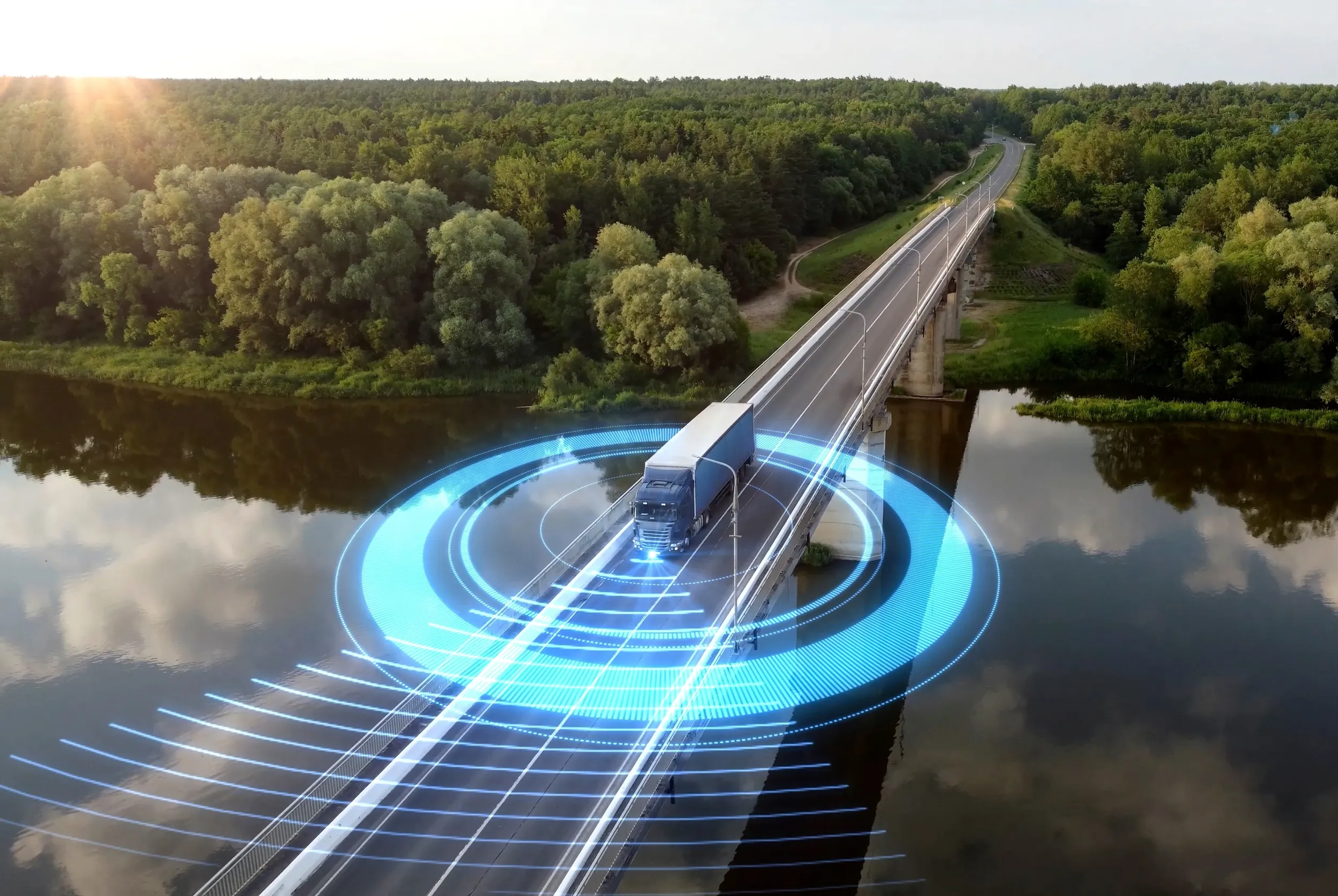

Distributed Ledger Technology Drives ROI

The information provided here is intended for informational purposes only and does not substitute for professional advice. Please refer to the terms of service for website usage.

Ready to Begin?

Subscribe to Applied Accountancy’s Insights Newsletter to get the latest news, analysis and compliance updates delivered directly to your inbox.

related insights

Fintech applications are slowly revolutionizing ways to invest in and promote environmental, social, and governance

...Efficient asset management is essential to businesses that are keen to maximize their investments, optimize

...The accountant’s role in mergers and acquisitions is crucial, particularly within strategic partnerships, in facilitating

...Managing the cash of a business, therefore, is very important for the profitability of the

...AP bots are strengthening and making more reliable contact between companies and suppliers by having

...Cryptographic hashing doesn’t just secure your operations; it opens doors to innovation, efficiency, and growth.

...Real-time data helps finance teams produce more accurate predictions, thereby optimizing cash flow and arriving

...Reshaping business efficiency by automating repetitive tasks, enhancing productivity, and reducing operational costs, RPA is

...The CPA Evolution Project, approved by NASBA and launching in January 2024, transforms CPA licensure

...What will it take for your business to stay competitive in 2024’s fast-evolving digital landscape?

...Corporate strategy and financial reporting are two closely related aspects of a business. Corporate strategy

...Accuracy and strict compliance in reporting financial information are fundamentally crucial to coping with the

...