Discover how the IRS’s adoption of AI is reshaping corporate tax compliance, increasing audit precision,

End of Content.

Explore the gift tax implications of transferring buy-sell obligations, including valuation methods, exemptions, and key

...Efficient asset management is essential to businesses that are keen to maximize their investments, optimize

...At Applied Accountancy, we’re proud to ensure that accountants and organizations can thrive in this

...Discover a holistic accounting approach in integrating tax planning and corporate strategy to optimize costs,

...Uncover the secrets behind the rapid adoption of cloud technology by private enterprises and learn

...Learn how cloud accounting software has developed from its early days to today’s AI-driven solutions.

...Conceded charge items are essential in the precision and straightforwardness of budget summaries. They emerge

...Explore the tax implications of tenancy by entirety, including estate planning benefits, creditor protections, and

...5G is more than faster internet; it is a platform capable of changing global financial

...A step-by-step guide on preparing financials, legal documents, and other operational data in preparation for

...In an era marked by globalization and rapid financial innovation, the battle against illicit finance

...Businesses and individuals around the world face an ever-changing environment of insalubrious and uncertain economic

...

Discover how the IRS’s adoption of AI is reshaping corporate tax compliance, increasing audit precision,

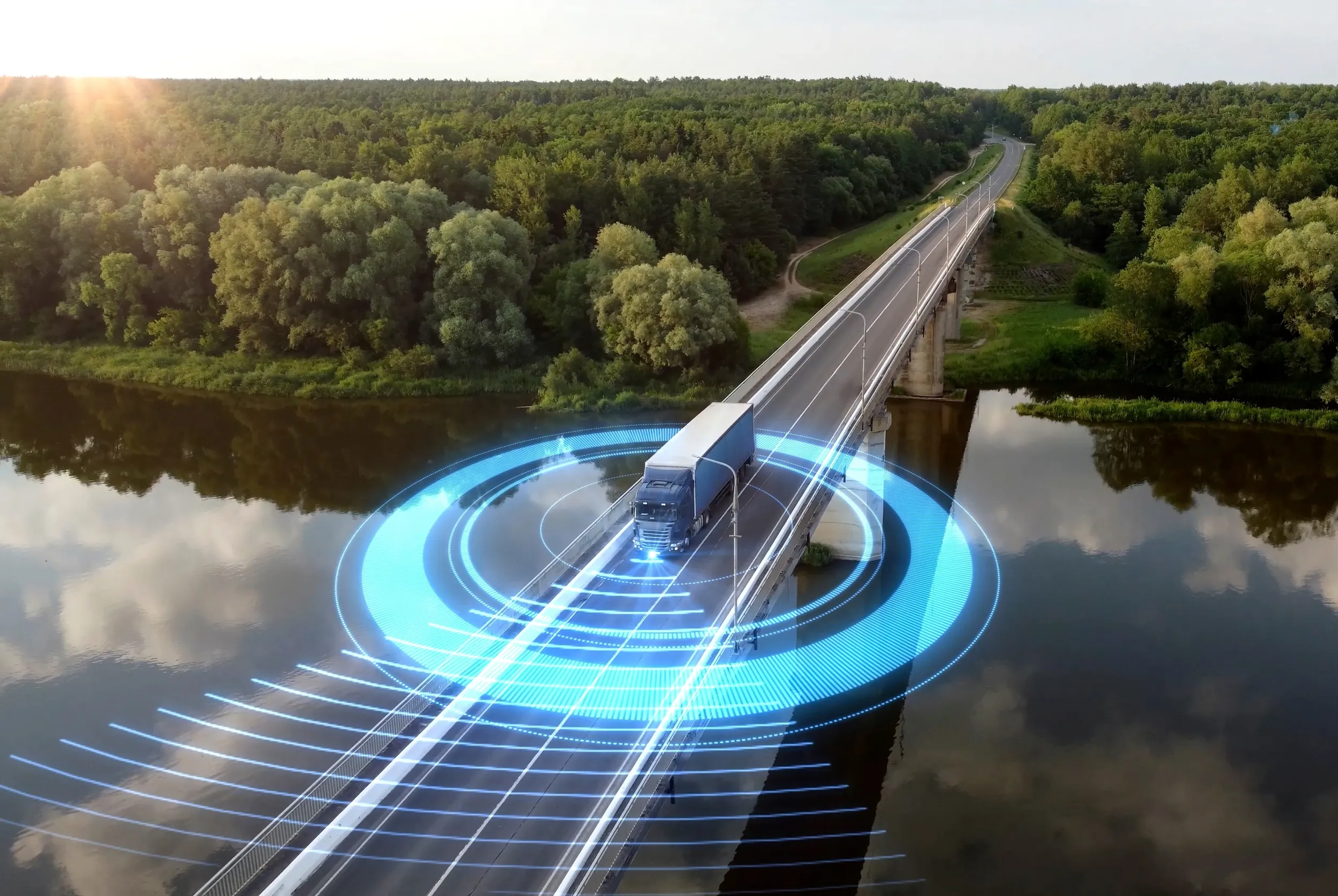

Supply chain challenges are poised to escalate in 2024. Stay ahead of the curve by

By rethinking their strategies and operations, insurers can create a future that not only meets

What will it take for your business to stay competitive in 2024’s fast-evolving digital landscape?

Stay updated with the latest changes in U.S. corporate tax laws for 2024. Discover key

The Employee Retention Credit (ERC) provides financial aid to businesses for retaining employees during the

As the year draws to a close, many business owners face the challenge of maximizing

Integration of accounting software with modern marketing tools like Stripe, Shopify, and Salesforce is a

With AI managing data entry and analysis, accountants now have more time to focus on

Virtual CFO (vCFO) services offer scalable, on-demand leadership support. that use automation, data analytics, and

As sustainability becomes a business essential, finance teams are at the forefront, driving both financial

Is the growing accounting talent shortage putting pressure on your business? Explore how outsourcing can

AI is raising the bar with respect to the efficiency of tax processes, reducing human

The Inflation Reduction Act offers organizations unique opportunities to leverage tax credits and drive innovation—unlock

High volumes of transactions, reporting, and operations in several locations have forced companies into such